Medium-term projections and statistics on general government finances provide a reliable basis for fiscal and economic policy decision-making. However, consistent and comprehensive statistical data on the finances of municipalities and wellbeing services counties is needed to support decision-making, and this data should be produced on a centralised basis. Correctly timed foresight reports and centralised coordination of information would increase the use of foresight information in decision-making and put the Government’s foresight activities on a more structured basis. In Government proposals, more attention should be paid to assessing the expenditure impacts of the proposed measures.

There is still room for improvement in the reporting on projections in the General Government Fiscal Plan

In 2019, the National Audit Office examined whether there is any need for improvement in the manner in which the Ministry of Finance prepares its medium-term projections. In the audit (17/2019), the Ministry of Finance was urged to diversify its range of methods, in particular to produce a real-time assessment of the business cycle for medium-term projections. According to the audit follow-up, there is now better coordination between the macroeconomic forecast and the business cycle assessments prepared as part of medium-term projections. The Ministry of Finance has also published a methodological description of medium-term projections, which shows that deviations from the assumption that the output gap will close can be made in the medium term. However, these measures do not yet eliminate the quality risk of the projections, which arises when the output gap estimate is retrospectively revised. The National Audit Office recommends that the definitions and comparability of development paths used in the reporting of medium-term projections should be improved. The target paths should also describe the estimated impacts of the planned measures on general government fiscal position.1

Fiscal statistics provide a solid basis for fiscal policy decision-making

Economic forecasting, planning and decision-making are based on fiscal statistics. Compilation of national statistics is based on EU-level cooperation and the EU law, and the activities are also supervised by the EU. According to the audit conducted by the National Audit Office, fiscal statistics are reliable and internationally comparable. The statistics provide a reliable basis for fiscal policy and economic decision-making.2

Eurostat applies a wide range of systematic quality assurance methods focusing on methodological and classification issues on the fiscal statistics produced by EU Member States to ensure that the national statistics are comparable. For this reason, Statistics Finland itself makes only limited use of quality assurance when producing fiscal statistics, and its processes of compiling statistics are not externally reviewed. The National Audit Office recommends that Statistics Finland should strengthen its statistical quality assurance and the ability of external parties to assess the quality of fiscal statistics.2

Statistics on the finances of municipalities, joint municipal authorities and wellbeing services counties should be organised on a centralised basis

The collection of data on local government finances was transferred from Statistics Finland to the State Treasury from the statistical year 2021 onwards as part of the overhaul of the collection of financial data from municipalities and joint municipal authorities (HE 60/2019). Until then, Statistics Finland collected the financial data required for statistics from municipalities and joint municipal authorities and used them to produce the annual and quarterly statistics on local government finances. The data was extensively used in the preparation of statistics on general government finances according to the national accounts, in the calculation of central government transfers and in the preparation of decision-making. In connection with the overhaul, Statistics Finland discontinued the compilation of statistics on local government finances, after which different actors have compiled sum data based on the original data collected from municipalities and joint municipal authorities for their own purposes. Thus, centralised statistics on local government finances are still needed as is financial data from the wellbeing services counties set up at the start of 2023. It is recommended in the audit that statistics on local government finances and the finances of wellbeing services counties should also in the future be produced on a centralised basis so that uniform financial data would be available for decision-making.2

The aim of the data collection reform was to ensure the availability of uniform, up-to-date and comprehensive information on the finances of municipalities, joint municipal authorities and other actors obliged to keep accounts, which would improve the usability of the data, especially in the preparation of the General Government Fiscal Plan and the Budget. In the new model, data collection is based on data automatically run from the accounts. One aim of the overhaul was also to eliminate overlaps in the collection of official data and to ease the burden on municipalities and other parties arising from the obligation to supply information. However, it was concluded in the audit that there have been significant delays in the provision of information on local government finances. Moreover, in the new model, data quality assurance is decentralised among several actors, which may create blind spots in quality assurance and lead to unnecessary duplication of work in the data verification process.2 However, the data collected with the new model does not currently cover all the data needed for Statistics Finland’s statistics on general government finances, which means that Statistics Finland has to use its own data collection methods to obtain the missing data.

Economic impacts of the reforms should be more comprehensively assessed in Government proposals

In its audits, the National Audit Office has repeatedly drawn attention to shortcomings in the assessment of the economic impacts of reforms in Government proposals. During this annual report period, the shortcomings were highlighted in two audits.

In the Government proposal (HE 60/2019), transferring the collection of the data on local government finances from Statistics Finland to the State Treasury was justified with cost savings. However, the savings that would be achieved were not estimated and no target for the savings was set in the proposal. In the Local Government Data Programme, which preceded the Government proposal, the savings were put at EUR 17 million by the year 2025. The Government also estimated in its proposal that the reform would bring minor savings to Statistics Finland and a number of other actors from 2022 onwards. Statistics Finland has later estimated that no cost savings can be expected in the coming years. The Government proposal also included spending increases. It was proposed that the permanent appropriation of the State Treasury should be increased by EUR 1.3 million from 2021. A total of EUR 5.5 million in separate funding was also allocated to the State Treasury for the period 2016–2020 for the collection of financial data on municipalities and joint municipal authorities.2

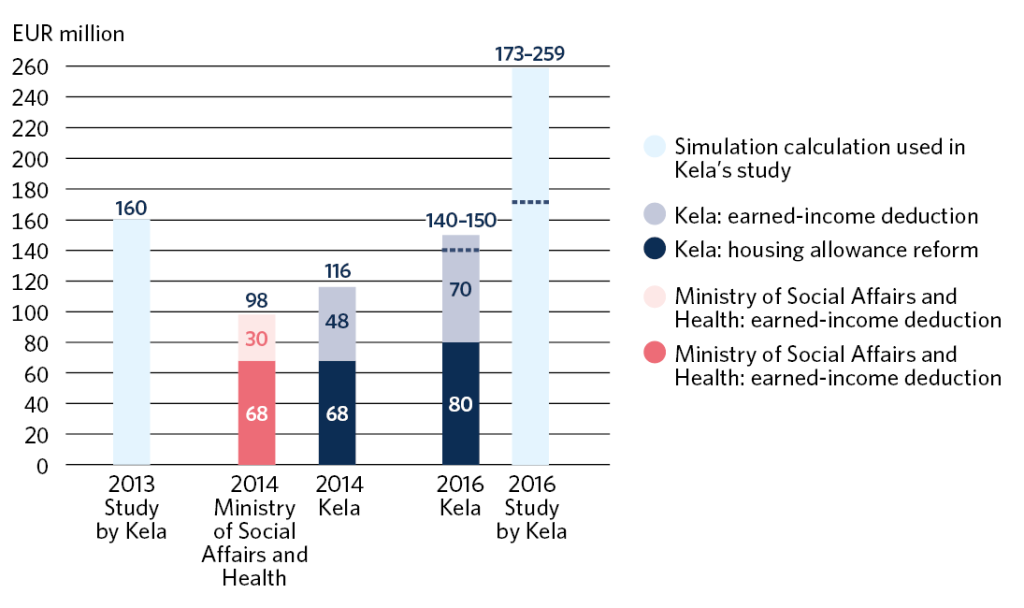

Finland’s general housing allowance scheme was overhauled in 2015, and an earned-income deduction was introduced as part of the reform. According to the Government proposal (HE 52/2014) on the overhaul, maximum cost-neutrality would be a key goal, and the reform was estimated to increase the expenditure on general housing allowance by EUR 68 million each year. The estimate did not include the expenditure impacts of the earned-income deduction even though it was already known when the proposal was under preparation that the introduction of the deduction would increase annual expenditure by at least EUR 30 million (Figure 1). Based on the audit, the reform has increased general housing allowance expenditure considerably more than anticipated in the Government proposal. Estimates of the annual expenditure impacts of the reform have varied between EUR 150 million and EUR 259 million. In its proposal, the Government should have presented the uncertainties arising from the expenditure impacts and the calculations produced during the preparatory phase.3

Foresight information – an important instrument in Government’s strategic decision-making

In addition to the knowledge arising from research, foresight information based on the views of a broad range of experts is an important part of the knowledge base used in strategic decision-making. The inclusion of foresight information in the knowledge base of decision-making requires the pooling of diverse information and expertise and the utilisation of the potential offered by digital data processing. Like research data, foresight information should be processed in accordance with the Information Management Act and the models and principles of information management.

The National Audit Office has assessed the national foresight system that supports the Government’s strategic decision-making.4 Based on the audit, the preparation process of the Government Report on the Future has supported foresight development in central government but the foresight activities in central government are not yet consistent or systematic as regards their purpose, objectives, operating methods or outputs. Producing systematic foresight information requires well-established processes, automated information production practices and development of the foresight capabilities of the actors preparing and implementing decisions. The fragmented nature of the foresight activities and uneven quality of the information constitute obstacles to the utilisation of foresight information in central government. Moreover, the responsibilities for producing foresight information, and the practices of coordinating and sharing the information in central government are not yet fully developed. Only a small number of central government units have their own foresight functions.4

Based on the audit, timely foresight reports and assignments arising from the preparation of policy measures would provide those drafting and making decisions with better opportunities to utilise foresight information in their work. Assignments and the preparation of reports would also put the foresight activities in government agencies on a stronger basis and strengthen their capacity to react to sudden changes in their operating environment. The cost-effectiveness of the foresight activities in government agencies could be improved by harmonising the information production process and by monitoring the resources and processes allocated to foresight. The knowledge base of Government decision-making would also be strengthened by a centralised coordinating support service combining information sources and maintaining location data on relevant information, even though the production of information would remain decentralised.4

Recommendations of the National Audit Office concerning foresight and processing of financial information

Statistics Finland should have stronger quality assurance procedures for compiling fiscal statistics. Centralised compilation of statistics on local government finances and finances of wellbeing services counties should be improved so that the data can be used in decision-making.2

The expenditure impact calculations of the proposed measures and the uncertainties arising from them should be included in the Government proposals.3

The cost-effectiveness of the foresight activities and the usability of information should be improved by boosting the efficiency of the information production process and coordination of information and by ensuring that the Government monitors the resources allocated to foresight.4